The Main Principles Of Stonewell Bookkeeping

Rumored Buzz on Stonewell Bookkeeping

Table of ContentsAll about Stonewell BookkeepingThe Only Guide to Stonewell BookkeepingThe 6-Minute Rule for Stonewell Bookkeeping9 Easy Facts About Stonewell Bookkeeping DescribedThe Best Guide To Stonewell Bookkeeping

Every company, from hand-made fabric makers to video game programmers to restaurant chains, makes and invests money. Bookkeepers help you track all of it. But what do they actually do? It's difficult understanding all the solutions to this concern if you've been solely focused on expanding your organization. You could not completely comprehend or even start to completely appreciate what a bookkeeper does.The history of accounting dates back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers maintained records on clay tablets to maintain accounts of purchases in remote cities. It was composed of an everyday diary of every transaction in the sequential order.

Local business might rely entirely on an accountant in the beginning, however as they grow, having both specialists aboard comes to be increasingly useful. There are 2 main sorts of accounting: single-entry and double-entry bookkeeping. documents one side of an economic purchase, such as including $100 to your expenditure account when you make a $100 purchase with your bank card.

Not known Facts About Stonewell Bookkeeping

includes taping monetary deals by hand or utilizing spreadsheets - business tax filing services. While low-cost, it's time consuming and prone to mistakes. usages devices like Sage Cost Management. These systems automatically sync with your bank card networks to give you charge card transaction data in real-time, and instantly code all data around expenses including projects, GL codes, places, and classifications.

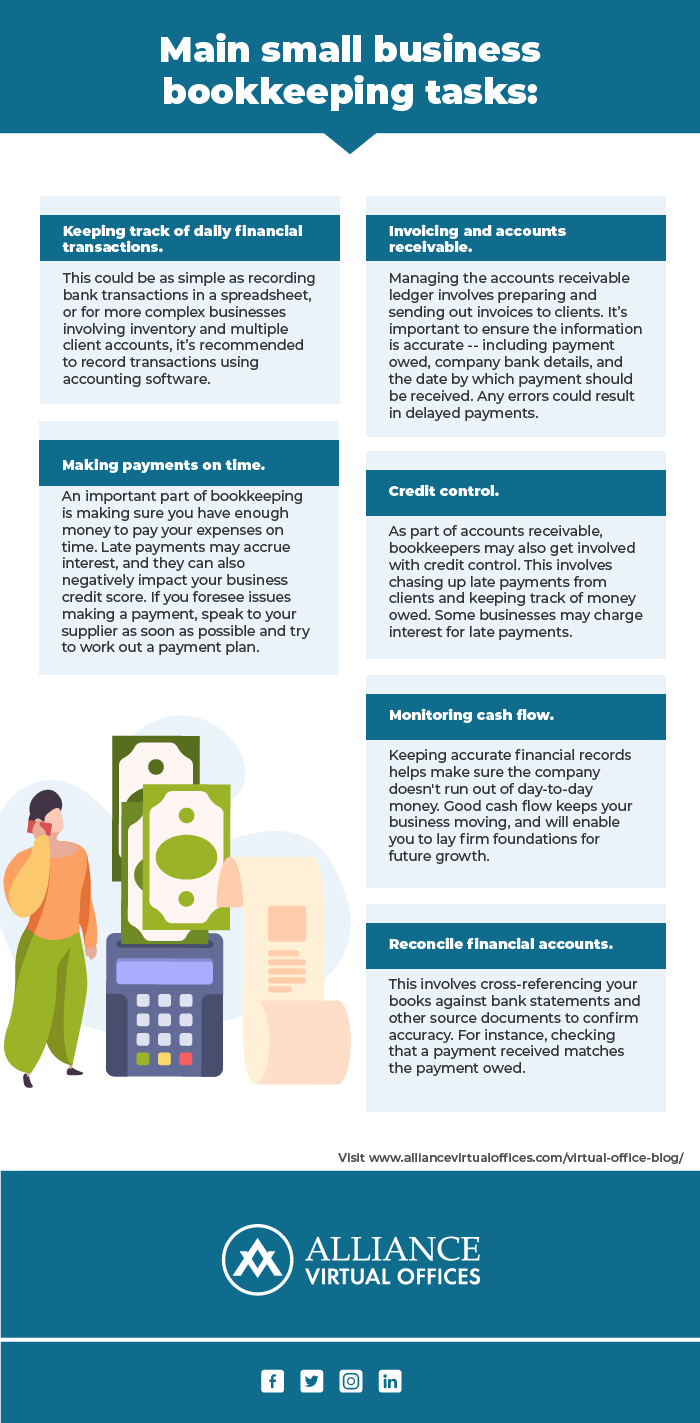

They ensure that all documents complies with tax obligation guidelines and regulations. They check capital and frequently create economic records that aid vital decision-makers in an organization to press the business ahead. Furthermore, some accountants likewise help in optimizing payroll and billing generation for an organization. An effective accountant needs the complying with skills: Accuracy is key in economic recordkeeping.

They normally begin with a macro point of view, such as an equilibrium sheet or an earnings and loss declaration, and afterwards pierce right into the information. Bookkeepers ensure that supplier and consumer records are always up to date, even as individuals and organizations change. They might additionally require to collaborate with various other divisions to make sure that everybody is utilizing the exact same information.

A Biased View of Stonewell Bookkeeping

Getting in bills into the audit system enables for accurate planning and decision-making. This assists companies receive settlements faster and improve cash flow.

This assists stay clear of discrepancies. Bookkeepers consistently carry out physical supply counts to prevent overemphasizing the value of properties. This is an important element that auditors very carefully examine. Include internal auditors and contrast their counts with the videotaped values. Bookkeepers can function as consultants or in-house workers, and their settlement varies depending upon the nature of their employment.

Consultants usually bill by the hour but might use flat-rate bundles for specific tasks., the ordinary bookkeeper wage in the United States is. Keep in mind that wages can vary depending on experience, education and learning, location, and industry.

The Buzz on Stonewell Bookkeeping

Some of one of the most common documentation that companies should submit to the federal government includesTransaction info Financial statementsTax conformity reportsCash circulation reportsIf your accounting is up to date all year, you can avoid a ton of anxiety throughout tax obligation period. White Label Bookkeeping. Perseverance and interest to information are vital to far better accounting

Seasonality is a part of any type of job on the planet. For bookkeepers, seasonality suggests periods when repayments come flying in via the roofing, where having outstanding job can come to be a significant blocker. It comes to be essential click now to prepare for these minutes beforehand and to finish any type of backlog before the pressure duration hits.

Stonewell Bookkeeping for Dummies

Avoiding this will minimize the threat of triggering an IRS audit as it provides a precise depiction of your financial resources. Some usual to maintain your individual and service financial resources separate areUsing a business bank card for all your business expensesHaving separate monitoring accountsKeeping invoices for personal and overhead different Imagine a world where your bookkeeping is done for you.

Employees can respond to this message with an image of the receipt, and it will instantly match it for you! Sage Expenditure Administration uses highly customizable two-way combinations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These assimilations are self-serve and require no coding. It can instantly import data such as workers, projects, categories, GL codes, divisions, task codes, cost codes, taxes, and much more, while exporting costs as expenses, journal entrances, or credit history card charges in real-time.

Consider the complying with tips: A bookkeeper who has actually functioned with organizations in your sector will certainly better comprehend your certain needs. Accreditations like those from AIPB or NACPB can be an indication of reputation and proficiency. Ask for referrals or inspect on the internet reviews to guarantee you're hiring a person trustworthy. is a great place to start.