What Does Transaction Advisory Services Mean?

The Ultimate Guide To Transaction Advisory Services

Table of ContentsThe smart Trick of Transaction Advisory Services That Nobody is Discussing3 Simple Techniques For Transaction Advisory ServicesThings about Transaction Advisory Services7 Easy Facts About Transaction Advisory Services DescribedThe Definitive Guide for Transaction Advisory Services

This step makes certain the organization looks its best to possible buyers. Getting the business's worth right is critical for an effective sale.Deal consultants action in to assist by getting all the required details organized, responding to concerns from customers, and organizing visits to the organization's location. Transaction consultants utilize their competence to assist business owners handle hard settlements, meet customer expectations, and framework deals that match the owner's objectives.

Satisfying legal regulations is crucial in any kind of organization sale. They help company owners in planning for their next actions, whether it's retired life, beginning a brand-new venture, or managing their newfound wealth.

Purchase advisors bring a wide range of experience and knowledge, making certain that every aspect of the sale is taken care of skillfully. Via calculated prep work, appraisal, and arrangement, TAS assists organization owners accomplish the highest possible sale rate. By guaranteeing lawful and governing conformity and managing due persistance alongside other offer team participants, transaction consultants decrease prospective risks and responsibilities.

The 25-Second Trick For Transaction Advisory Services

By contrast, Huge 4 TS groups: Deal with (e.g., when a prospective purchaser is performing due persistance, or when an offer is shutting and the purchaser needs to incorporate the business and re-value the vendor's Equilibrium Sheet). Are with fees that are not linked to the offer closing efficiently. Gain costs per engagement someplace in the, which is much less than what financial investment banks earn even on "tiny offers" (however the collection likelihood is also a lot greater).

, but they'll concentrate much more on audit and evaluation and less on topics like LBO modeling., and "accounting professional only" topics like test equilibriums and how to walk via occasions making use of debits and credits instead than monetary statement changes.

The Single Strategy To Use For Transaction Advisory Services

Specialists in the TS/ FDD groups might also speak with management about every little thing over, and they'll write an in-depth report with their searchings read this post here for at the end of the procedure.

, and the general form looks like this: The entry-level duty, where you do a lot of data and monetary analysis (2 years for a promotion from below). The next level up; comparable work, but you obtain the even more interesting little bits (3 years for a promo).

In specific, it's difficult to obtain advertised beyond the Supervisor degree due to the fact that couple of people leave the job at that phase, and you require to begin showing proof of your capability to produce revenue to advance. Allow's begin with the hours and way of living considering that those are less complicated to define:. There are occasional late evenings and weekend break job, yet absolutely nothing like the agitated nature of investment banking.

There are cost-of-living modifications, so expect reduced settlement if you're in a more affordable area outside major financial (Transaction Advisory Services). For all settings except Companion, the base salary makes up the bulk of the complete compensation; the year-end incentive could be a max of 30% of your base wage. Typically, the very best way to raise your earnings is to switch over to a different company and work out for a higher income and reward

The Of Transaction Advisory Services

You might get pop over to these guys involved in corporate development, but investment financial obtains a lot more difficult at this stage since you'll be over-qualified for Analyst functions. Company finance is still an alternative. At this stage, you ought to just stay and make a run for a Partner-level role. If you intend to leave, maybe move to a client and do their evaluations and due persistance in-house.

The primary issue is that due to the fact that: You usually need to sign up with an additional Big 4 team, such as audit, and job there for a couple of years and after that relocate right into TS, next job there for a couple of years and after that relocate into IB. And there's still no guarantee of winning this IB function because it depends upon your region, clients, and the working with market at the time.

Longer-term, there is additionally some danger of and since assessing a business's historical economic details is not precisely brain surgery. Yes, people will always need to be included, but with more innovative modern technology, reduced head counts can possibly support client interactions. That said, the Purchase Providers group beats audit in terms of pay, job, and exit chances.

If you liked this post, you may be thinking about reading.

Transaction Advisory Services - The Facts

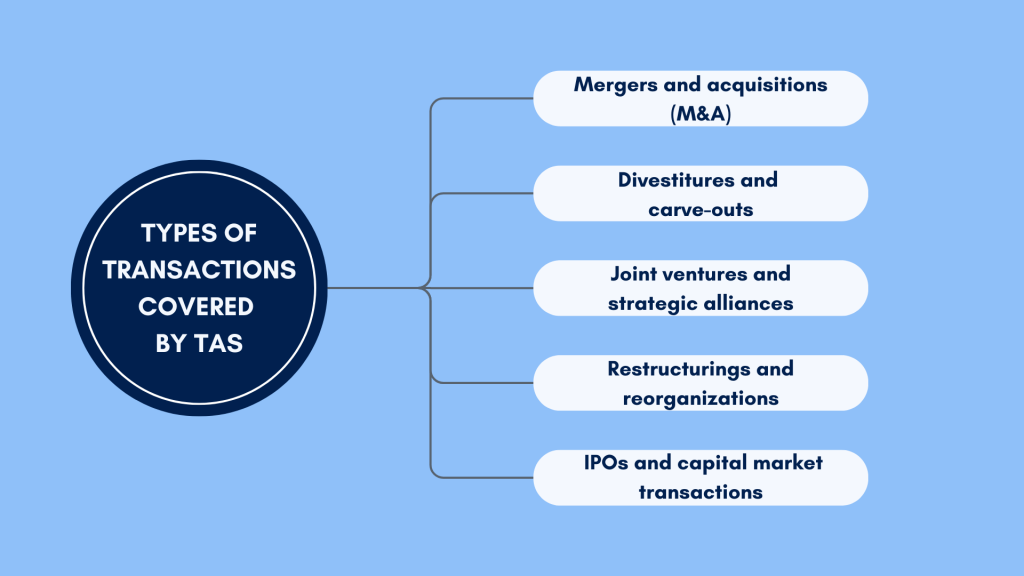

Create innovative economic frameworks that aid in figuring out the actual market price of a firm. Provide advisory operate in connection to service valuation to aid in bargaining and prices frameworks. Explain the most suitable form of the deal and the kind of factor to consider to use (money, stock, make out, and others).

Establish action plans for risk and exposure that have actually been recognized. Perform integration planning to determine the process, system, and organizational modifications that may be called for after the offer. Make mathematical price quotes of integration prices and advantages to evaluate the financial rationale of integration. Set standards for integrating departments, innovations, and company procedures.

Recognize possible reductions by lowering DPO, DIO, and DSO. Analyze the potential client base, market verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence uses essential understandings right into the functioning of the firm to be obtained worrying risk analysis and value production. Identify short-term alterations to finances, banks, and systems.